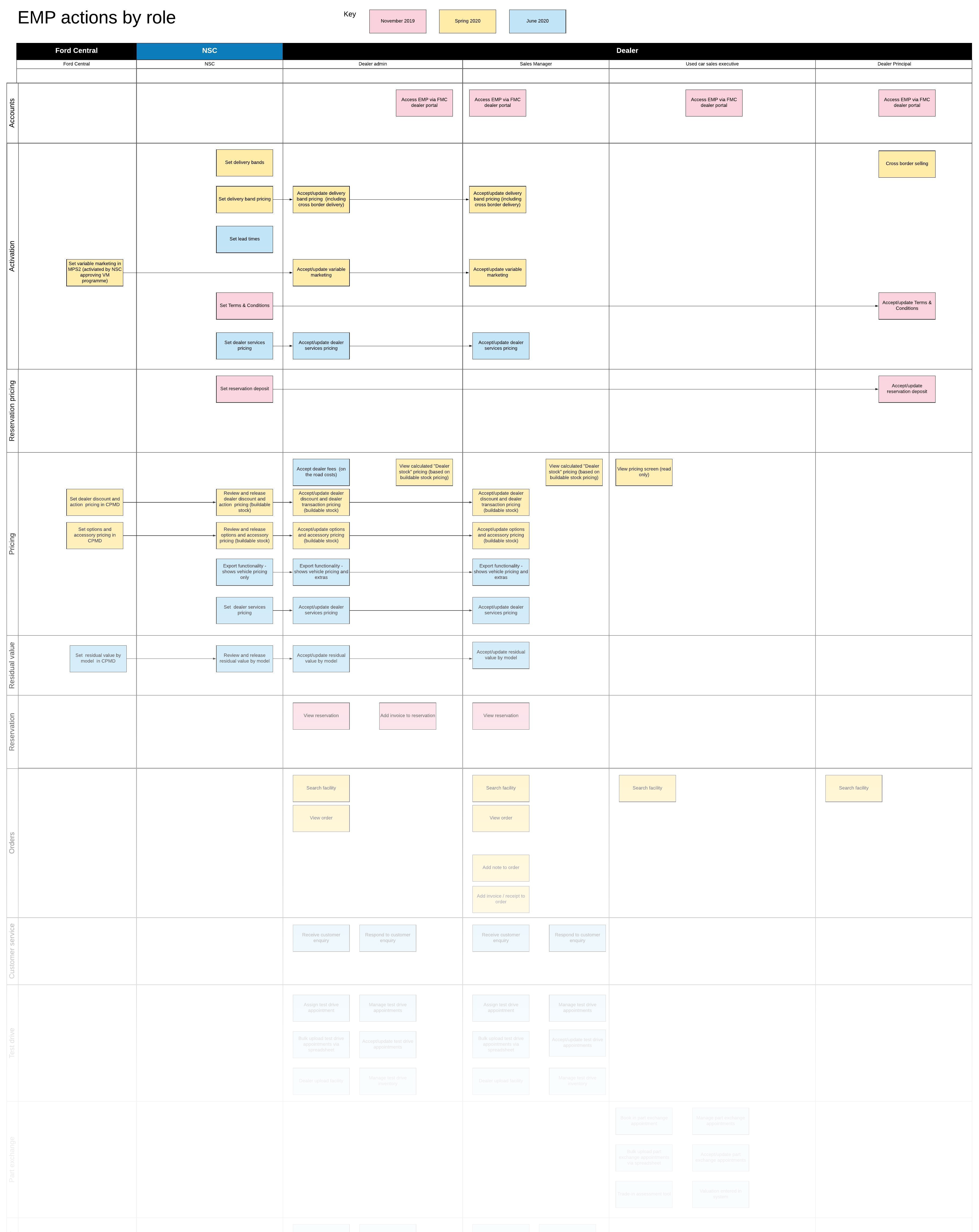

My first priority was to organize a workshop with key stakeholders from Ford, including several former dealership owners. This collaborative session was invaluable in quickly bringing me up to speed on the business requirements while also providing firsthand user insights from those with direct experience in dealership operations.

To ensure a smooth and effective rollout of the vendor portal, the project was structured into clear phases, meticulously drawn up by the business analyst. These phases served as the backbone of our project management strategy, guiding us through the complexities of delivering a user-centric platform under tight deadlines.

Sprint 1: Requirements Backlog

focused on reviewing and prioritizing the business requirements for the MVP.

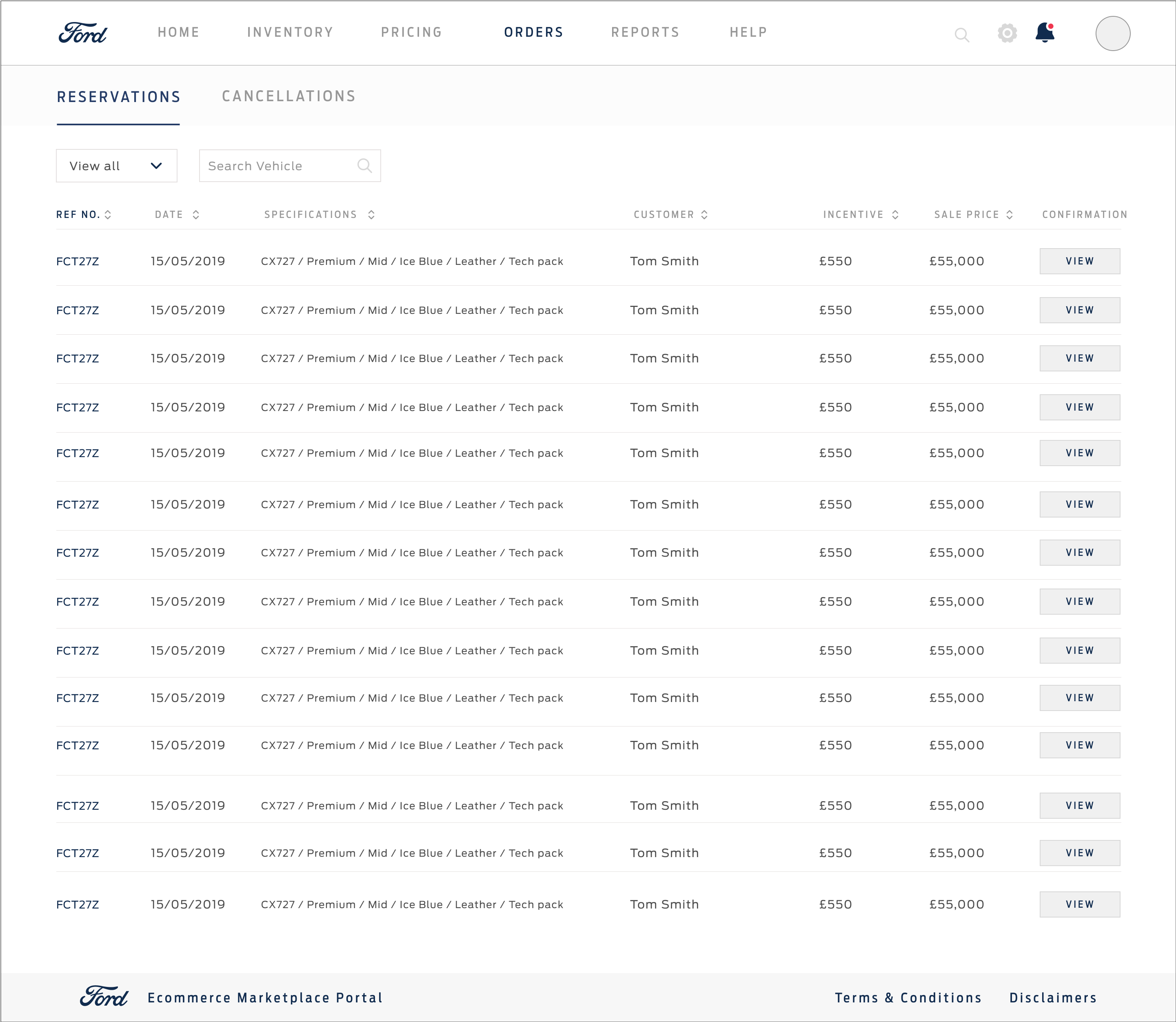

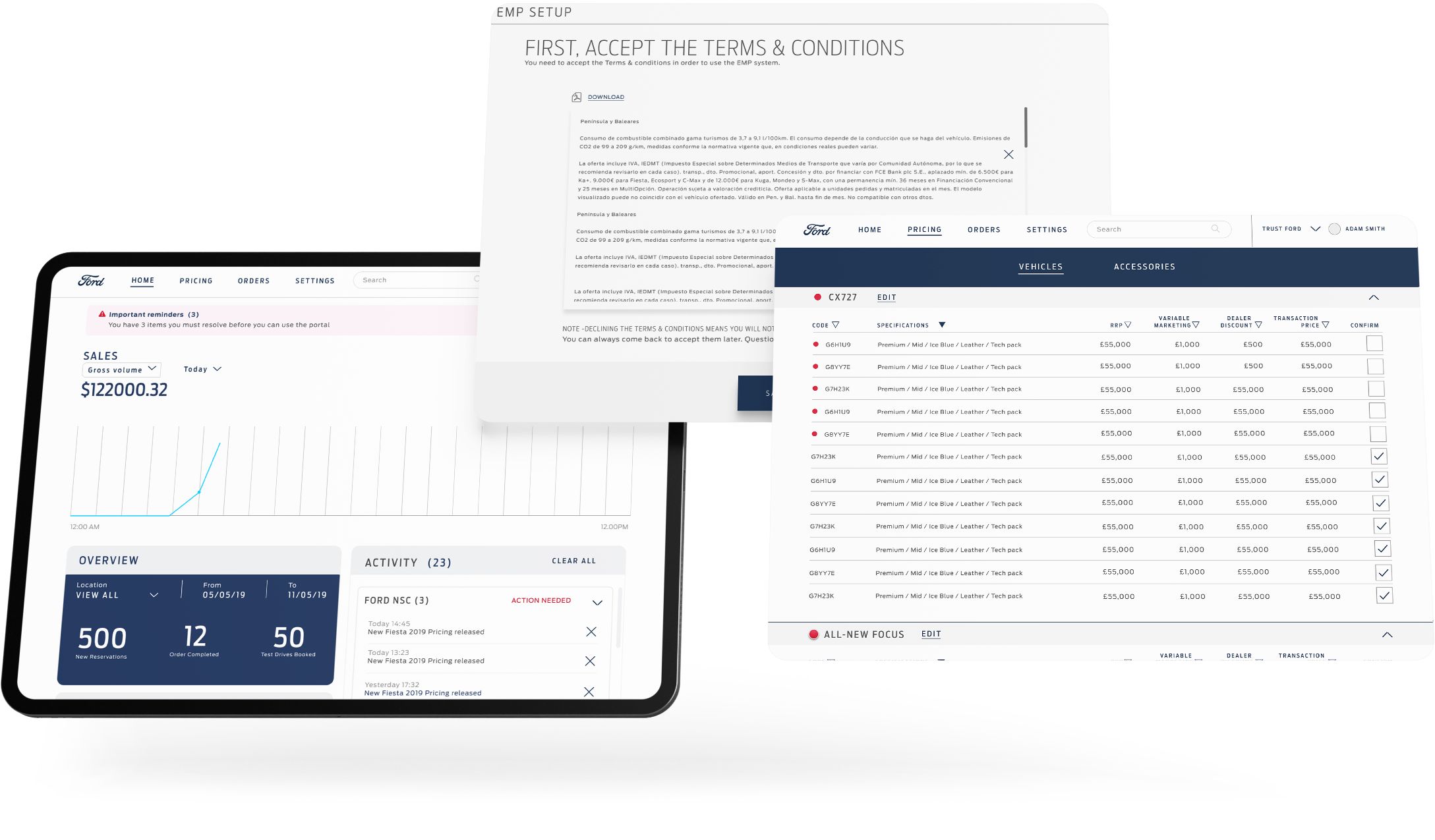

Sprint 2: UX Wireframes & UI Design

In this phase, I developed the UX stories and wireframes for the highest-priority elements, ensuring that they aligned with the broader strategic goals.

Subsequent Phases (Sprints 3-6)

Planned for continued design refinement, user testing, and iterations based on stakeholder feedback.